A.I. Lifted Stocks in 2025, but Market Concentration and Political Risks Shadow 2026

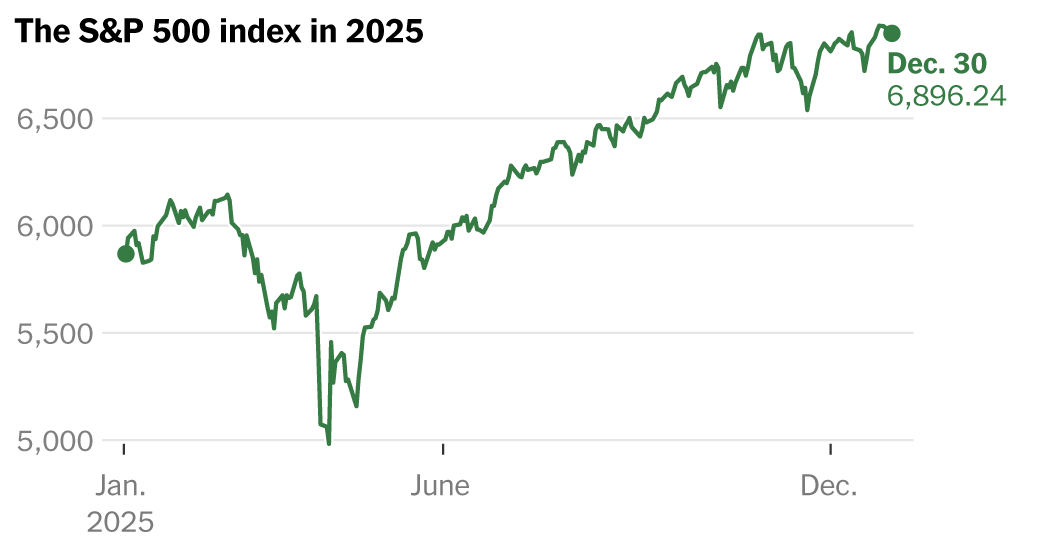

U.S. stocks finished 2025 with gains broadly in line with expectations, but the path was volatile. The S&P 500 climbed 16.4 percent for the year even as the Federal Reserve cut interest rates by three-quarters of a percentage point. The rally was driven largely by investments tied to artificial intelligence.

Economists estimated more than 90 percent of economic growth in the first half of 2025 came from spending on computer equipment and software as companies raced to build data centers and A.I. infrastructure. Seven of the S&P 500's top 10 performers were linked to the A.I. surge. SanDisk, spun off from Western Digital, rose more than 500 percent; its former parent climbed nearly 300 percent.

Other big winners included data-center suppliers, semiconductor-equipment makers and A.I.-linked software and services firms. The biggest influence on the index remained the so-called Magnificent Seven — Microsoft, Nvidia, Alphabet, Amazon, Meta, Tesla and Apple — which together rose about 25 percent for the year.

Nvidia alone nearly gained 40 percent, increasing its market value by roughly $1 trillion to around $4.5 trillion and accounting for about 15 percent of the S&P 500's total return. Investors and strategists warned the rally masked weakness elsewhere and became highly concentrated in a few names.

Key Topics

AI, United States, Business, Stocks, Markets, Economy, Federal Reserve