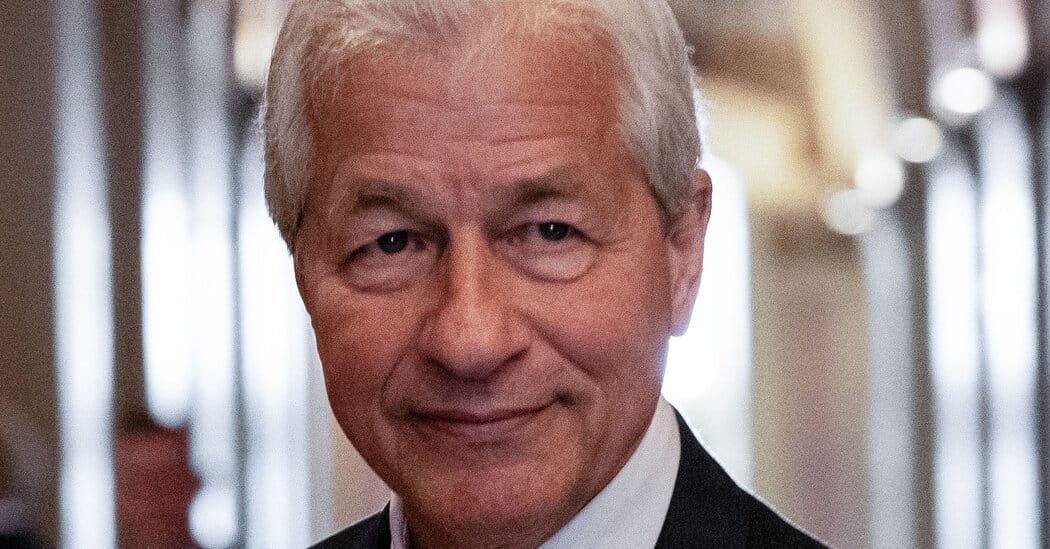

Jamie Dimon earned roughly $770 million in 2025 as banking rules eased

Jamie Dimon, chief executive of JPMorgan Chase, received roughly $770 million in 2025, according to the company’s disclosures, a sum made up of salary, bonuses, dividends, stock grants and appreciation in shares. The payout came as the Trump administration has loosened regulations and reduced enforcement, the article said, making it easier for banks to trade in risky assets such as cryptocurrency and pausing enforcement of foreign anti‑bribery rules.

Falling interest rates, more permissive antitrust oversight and a renewed boom in deal making — exemplified by a $100 billion bidding contest over Warner Bros. Discovery — also boosted banks’ trading and advisory businesses, the report said. Other large banks saw big share gains in 2025: the piece said big bank stocks rose about 29 percent on average, JPMorgan’s shares rose 34 percent, Citi’s were up more than 65 percent, Goldman Sachs up 53 percent and Capital One up 36 percent.

The story said Citi’s and Goldman’s chief executives earned more than $100 million each and that Capital One’s Richard Fairbank took in more than $300 million, including proceeds from stock sales and a $30 million bonus tied to the bank’s acquisition of Discover Financial. Most executives’ totals include gains on stock they have not yet sold and that they must remain employed to fully collect, the article noted.

Key Topics

Business, Jamie Dimon, Jpmorgan Chase, Banking Deregulation, Trump Administration, Richard Fairbank