XRP climbs to $1.87 as exchange-held supply falls to eight-year low, $2 remains key hurdle

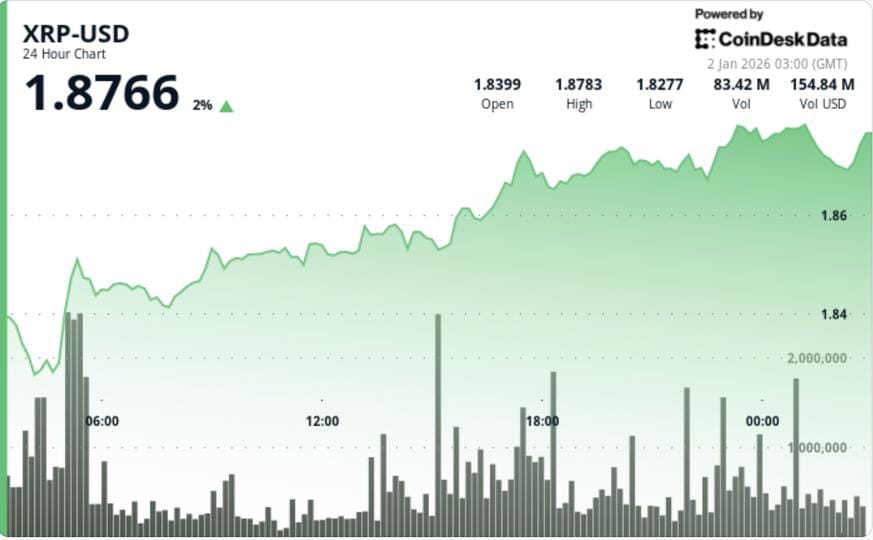

XRP pushed up to $1.87 as exchange-held supply fell to its lowest level since 2018, reinforcing a tightening-float narrative even as the price remains capped below the heavy $1.88–$2.00 resistance band. Balances on trading venues have dropped to roughly 1.6 billion XRP, down about 57% since October, suggesting more tokens are moving into longer-term storage or custody rather than sitting ready to be sold.

The drawdown in exchange inventory arrives while institutions increasingly use structured and regulated rails for exposure and spot markets remain choppy, leaving XRP with a supportive long-term bid but fragile short-term momentum. Technically, XRP climbed about 1.7% from $1.84 to $1.87, printing higher lows and holding a contained $0.05 range.

Volume expanded during the move, peaking around 32 million—roughly 50% above average—indicating stronger participation during the push higher. Price repeatedly slowed near the $1.88 area, which aligns with a broader resistance zone ahead of the psychological $2.00 handle. Momentum indicators are mixed: some oscillators show bullish divergence, but follow-through above resistance is needed to validate gains.

Key intraday support sits at the $1.82–$1.83 base, with a broader floor around $1.77. Bull case: a sustained break above $1.88 could open a run toward $1.95 and make $2.00 the breakout trigger. Bear case: failure to hold $1.82–$1.83 shifts attention back to $1.77 and then lower support regions.

Key Topics

Crypto, Xrp, Ripple, Exchange Supply, Resistance, Market Structure, Volumes