MicroStrategy Stock Near $139 Support as 20% Decision Zone Looms

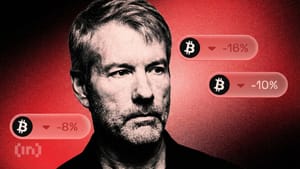

Beincrypto reports MicroStrategy (MSTR) has fallen about 62% since October versus Bitcoin’s 38%, acting as a leveraged Bitcoin proxy with a 90-day rolling correlation near 0.97. After weeks of heavy pressure, the stock is trying to stabilize; Bitcoin’s rebound near $79,000 at press time eased cost-basis fears after Bitcoin briefly dipped under MicroStrategy’s average purchase price of around $76,000.

Correlation measures direction, not size: MSTR tends to follow Bitcoin’s trend but leverage, balance-sheet exposure and sentiment amplify moves, so downside risk remains elevated if Bitcoin weakens again. Capital-flow indicators send mixed signals. The Chaikin Money Flow has trended higher since mid-January and is approaching the zero line, suggesting selective accumulation, while On-Balance Volume has trended lower and broken its rising trendline, indicating weaker participation and fainter retail support.